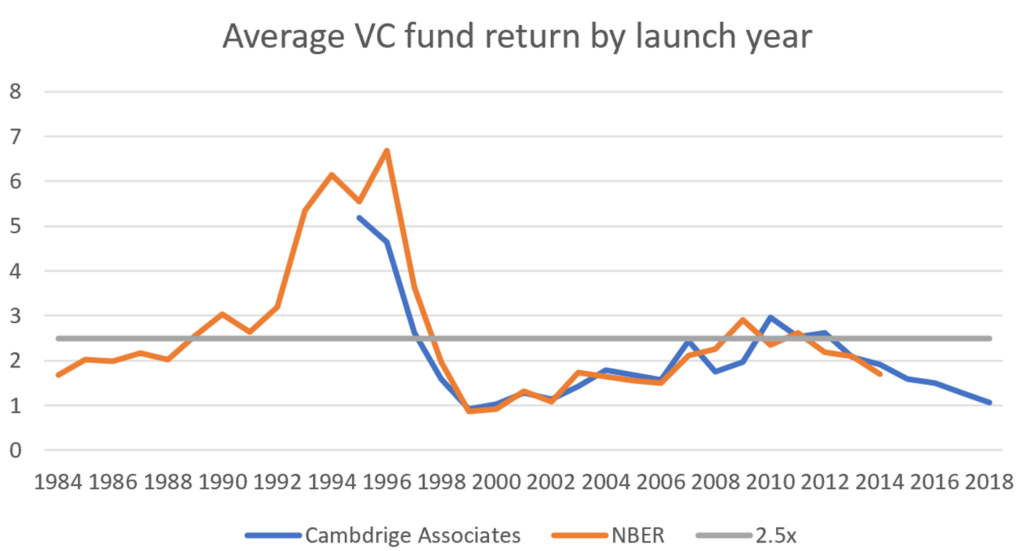

Venture capital firms promise great returns to their investors by betting on risky start-ups. As a rule of thumb, their promise is to multiply investors’ money by at least 2.5, or a “2.5x return,” after deducting management fees and the VC firm’s share of the profits. To put this in perspective, the stock market has historically generated a 1.6x return in a five-year period, which is for how long VCs tend to hold their investors’ money.

The investors, usually called limited partners or LPs, expect a higher return compared to the stock market for two reasons. First, their money is locked in for a few years, compared to holding public stocks which can be easily sold off at any time, so they expect to be compensated for that restriction. Second, investment in start-ups has a larger downside compared to other forms of investment—a lot of start-ups lose all of investors’ money. LPs expect a higher return to compensate their risk taking.

But have VCs generated the intended returns?

VC firms are very secretive about their performance; they rarely disclose performance figures to the public and their LPs are contractually forbidden to do so. Sequoia Capital, the world’s largest VC firm, went as far as cutting its 22-year relationship with an LP for fear that a Freedom of Information Act request would force it to share performance figures publicly.

But all is not lost. Over the past two decades, at least a couple of organizations have collected and tracked performance data of hundreds of VC funds, without naming names. One of them is an investment consulting company called Cambridge Associates. In a 2020 report, it shared the performance of 1,529 VC funds launched since 1995. The performance data was shared voluntarily to them over the years by fund managers. Another similar report was published in 2020 by the U.S. National Bureau of Economic Research (NBER), which shared performance metrics of 1,329 VC funds launched between 1984 and 2014. Here are the results:

We can see that, on average, VC funds launched throughout the years have not provided the expected 2.5x return to LPs; performance has been underwhelming at best. The most notable exception was the dot-com bubble period, during which VC funds did generate good returns, mostly by selling their shares to the public for inflated prices before the crash.

As VCs don’t generate good returns overall, it has become customary to highlight that the top VC funds do generate good returns. In particular, industry promoters tend to share performance figures of the top 25% of VCs, or the top quartile. The founder of a VC firm explained, “Top quartile VC funds generate strong returns” and “The top one percentile, meaning those that generate better returns than 99% of their peers, generate outstanding returns.”

A study of 1,329 funds showed that, indeed, funds in the top 25% generated returns that exceeded, on average, the desired 2.5x, although not as much since the dot-com crash. The other three quartiles, covering the bottom 75% of funds, did not provide good returns on average:

| Top 25% | 25%–50% ranking | 50%–75% ranking | Bottom 25% | |

| Average return (fund launched up to 2000 included) | 5.34x | 2.16x | 1.32 | 0.69 |

| Average return (fund launched since 2001) | 3.84x | 1.85x | 1.30x | 0.72 |

This kind of analysis is problematic though because the observation that top funds perform better than the rest is self-fulfilling. Similarly, if you measured the height of the top 25% tallest people in a city, then they’d be rather tall on average! It is tempting to think that there’s a group of talented VC firms at the top whose strategy is superior. However, it could be out of pure randomness or luck that the top funds end up at the top.

If the different funds managed by the same VC firm were consistently at the top, then we could argue that their investment strategy is superior. A study showed that there is a little bit of persistence in the firms whose funds end up at the top. Such persistence is, however, quite mild and cannot be successfully exploited by LPs. Suppose a firm with a fund currently at the top 25% raises another fund. The new fund has 33% chances of ending up in the top 25%. This is a bit higher than random, which would only give the new fund a 25% chance of being in the top 25%, but there is still a whopping 67% chances of the fund landing on the underperforming 75%. Moreover, a study suggested that the mild persistence of top firms may not really be down to talent. Instead, an initially good strike, due to luck, makes the VC firm more prestigious and gives it access to better deals: “entrepreneurs accept lower valuations and less attractive terms from more prestigious VC firms when choosing between offers.” In addition, the persistence of funds at the top fades over time: “VC firms with larger numbers of investments converge to the industry average success rate.”

These results suggest that the VC model does not work well for LPs in general. Only a lucky few make good money, and it’s unlikely that they can repeat the experience when they invest in a new fund. As VCs make a lot of money from management fees, which they charge independently of the success of their investments, the model may be working well for the VCs themselves.